The Value of On-Premise Channels: Why Businesses Get It Wrong

In the beverage industry, there’s a prevailing belief that on-premise channels offer an optimal environment for recruitment and brand building. These channels encompass shops and venues where beverages are consumed on-site, such as quick-service restaurants, bar/restaurants, hotels, theme parks, movie theaters, airports, and more. Evaluating the value of on-premise requires a more nuanced approach that goes beyond the surface rather than a simple straightforward assessment based solely on sales volume.

Looking Beyond the Surface

The challenge lies in recognizing that value extends beyond immediate sales figures. Some channels may even exhibit a net negative margin, yet they hold strategic importance by driving new trials and offering an important opportunity to recruit consumers to the brand. In simpler words, the assessment of value involves a comprehensive analysis that considers factors beyond just traditional sales metrics.

To make informed decisions on where to focus investments, a multifaceted evaluation is crucial. Consideration should be given to the channel’s impact on brand visibility, its role in fostering new product trials, the experience consumers have with the product, and its effectiveness in attracting and retaining consumers. This holistic evaluation enables a more comprehensive understanding of the value proposition associated with different on-premise channels, guiding strategic investment decisions for long-term brand success.

The Key Elements to Assess On-Premise Value

As an example, we will use our recent work with a global beverage manufacturer where we examined four key elements to assess the value of on-premise channels to determine where to invest and answer the brand’s burning questions.

1) Attractiveness: Identifying and tracking an on-premise channel’s attractiveness is the most straightforward metric. We assess its appeal by examining key factors such as the volume of traffic (the number of visitors), total sales, growth rate, and the prevalence of beverage consumption at the location. An attractive channel serves as a substantial platform for brand building, facilitating the introduction of new products, and attracting new consumers to the brand.

2) Strategic fit: Strategic fit is contingent on aligning your objectives with the desired outcome and maintaining consistency with your brand image. For instance, it would be counterintuitive to target bar/restaurants if your brand is positioned as a health food brand. Therefore, strategic fit is a careful consideration of who you aim to win over and how your brand is perceived. The target consumer can be based on many different characteristics: demographic, geographic, psychographic, or consumption-based (are they consuming categories like yours already). Once you determine who they are, identifying where they typically consume and prioritizing those channels is key. By focusing in on a specific consumer segment, you can build a connection that meets the preferences of the target consumers and reinforces the brand identity in a meaningful way.

3) Ritual driver: Consumer research can help us understand whether people who use specific channels are likely to try new products and continue using them in the future. By studying the connection between channel visits, product trials, and future consumption intentions, we can identify prime channels to drive future rituals in consumers. Prioritizing channels with high new product trial rates and strong intent for future consumption can effectively attract new consumers and build future habits.

4) Experience driver: Consumer research also guides us in understanding if certain channels enhance consumer experiences. As we discover what consumers like, we can pinpoint where placing products boosts overall experience. However, it’s not just about practical features. It’s about creating positive emotions and associations. Channels that stand out for enhancing consumer experiences should become strategic focal points, and placing products in these channels means more than a simple transaction. It contributes to a memorable and improved consumer experience, deepening connections, strengthening brand loyalty, and fostering positive word-of-mouth. In short, the focus on consumer experience emphasizes the importance of selecting channels where your product can significantly enhance positive and lasting impressions.

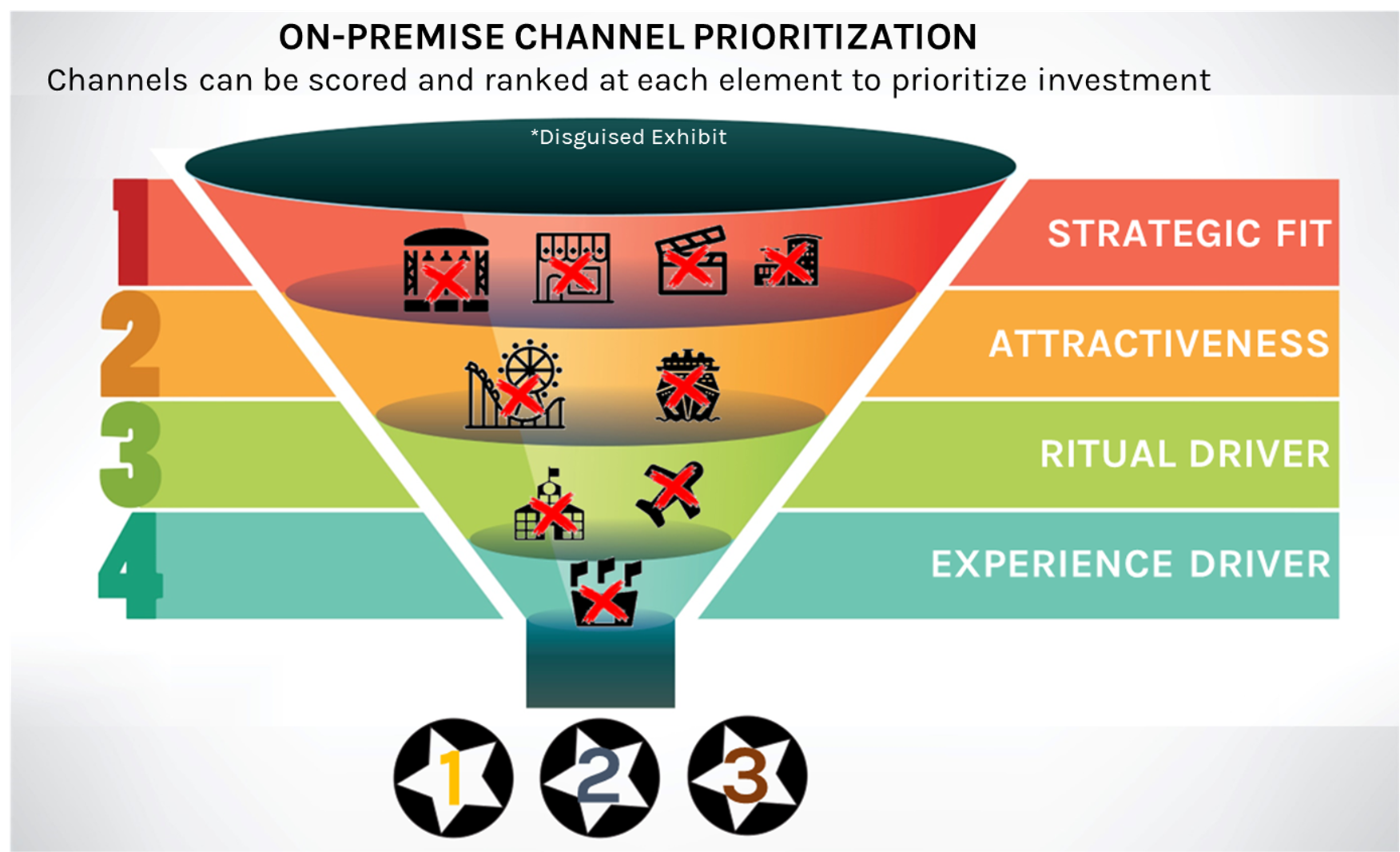

Using these 4 key elements, we evaluate each potential channel by various criteria to help brands decide where to invest. One common method for prioritization is a funnel approach, starting with a strategic fit for our target audience. We then assess attractiveness and identify top channels. Following that, we shift our focus to finding, within those channels, the ones that drive rituals and experiences for our target categories and brands.

Alternatively, we can assign weights to different metrics and create aggregate scores, however, this may oversimplify the channels’ complex value propositions. The funnel approach encourages strategic discussions, allowing us to dissect each element of value associated with the channel, adding significant value to the decision-making process. This comprehensive approach adds significant value to the decision-making process for on-premise channel prioritization, ensuring strategic investments are aligned with long-term brand success.

In our client collaborations, this framework has been instrumental in guiding strategic investments for the next 3-5 years to engage the upcoming generation of consumers. It not only facilitates informed decision-making but also highlights compelling reasons to prioritize specific channels. Furthermore, it aids in constructing robust business cases for effectively presenting and implementing the strategy across the broader organization.