Findings on how COVID-19 is (Forever?) Changing Consumers

Hello,

Good morning, and welcome to our Q2 newsletter. I hope this email finds you well and safe during these difficult times.

We have seen recent studies that suggest most people are tired of hearing about COVID-19. And yet, you will not be surprised to learn that the theme of this newsletter is the impact it will have on consumer behavior. We hope you will be surprised by a few unexpected findings from our own research.

We intentionally waited for the panic phase to be over before reaching out to consumers in the U.S. to understand the longer-term implications on their behaviors. Our findings reveal the complexity that comes with trying to understand an uncertain future, and the opportunities that are hidden behind the trends that some researchers have shown.

As we designed our study, we reviewed many others from different industries and organizations. In our “In the News” section we have listed for you several studies that we found particularly useful.

Given our passion for System Dynamics we have also shared a link to a model that can help you think about the future. I still remember one of my first exposures to a System Dynamics model (an MIT model on the spread of HIV), and I remember being fascinated by the ability to visualize the structure behind observed behaviors and to enable better conversations on policies to improve future outcomes. This passion, and the striking similarities with dynamics observed in consumer choice, drove me to explore the applications to brand growth strategy that we now use at Foresight.

I hope you enjoy reading! Please feel free to reach out to us with any questions as we continue to explore the data.

Vittorio Raimondi

Managing Director, Foresight Associates LLC

Our Study (and a Few Findings)

As the initial seismic impact begins to settle and people reflect on the new lifestyle brought about by the pandemic, we asked 1,000 USA respondents how their attitudes have changed, and which new behaviors are likely to stick.

New Habits: Consumers tell us that some lifestyle changes are here to stay

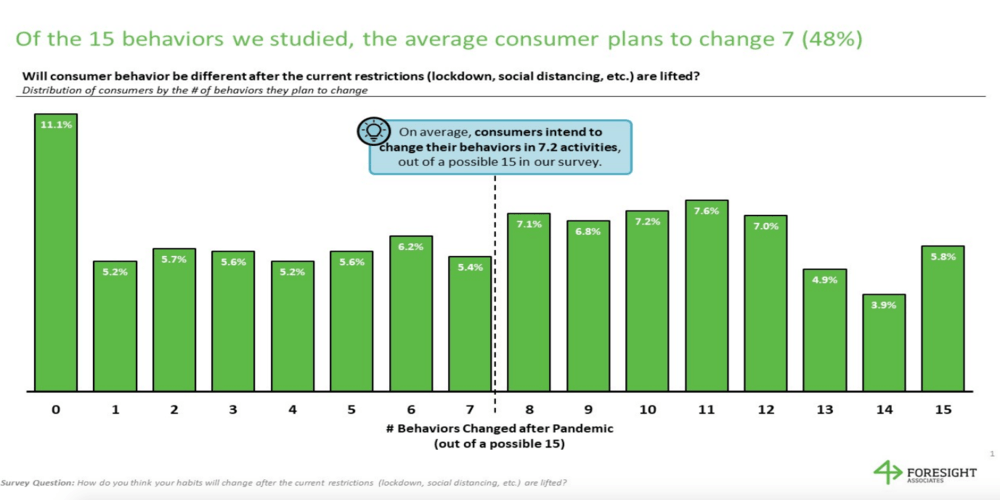

Thinking about their lives before the pandemic, we asked consumers whether they planned to change their behaviors in the future (once all restrictions are lifted). Their responses speak to the uncertainty consumers are facing. Out of the 15 behaviors we studied, the average respondent intends to change 7 of them.

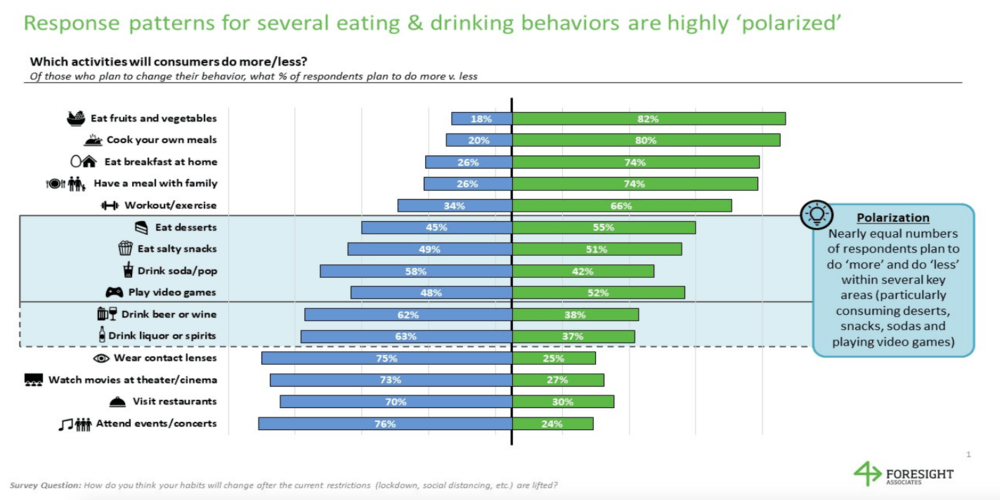

It is no surprise that the most likely to change are social activities that occur outside the home (>60% of respondents plan to change these habits) – visiting restaurants, attending events/concerts, going to the theater/cinema – all things that people plan to do less.

This is followed by a group of activities that mostly occur at home – cooking meals, having a meal with family, working out & exercising, and playing video games. 46-48% expect to change these behaviors, mostly with the intent to do more than they used to (video games are an exception).

The least likely to change include several eating & drinking habits, with ~40% of consumers planning to change their habits, but with less clear directionality (see 3rd finding).

Implications: Hospitality & entertainment have already been profoundly impacted, and these results suggest that they are also likely to experience the deepest and longest lasting changes. Businesses that can ‘weather the storm’ by finding new ways to engage consumers have an opportunity to build a long-term competitive advantage. This evolution will have ripple effects that touch other businesses including sponsor brands in the entertainment space, which will need to be prepared to respond to these changes.

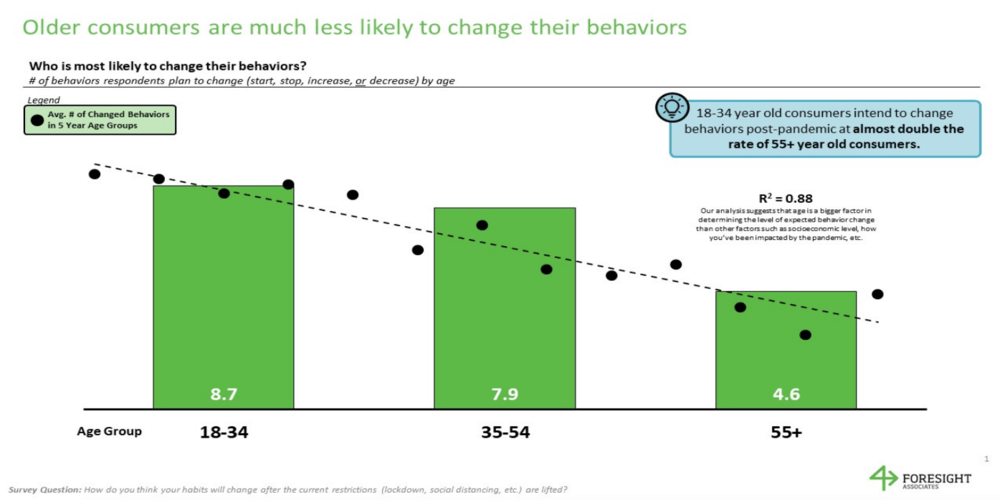

A surprising trend: Although older consumers face greater health risks from COVID-19, younger consumers are more likely to change their behaviors

Not surprisingly, we see a strong correlation between the extent to which consumers have been impacted by the pandemic and the amount of behavioral change they plan to make. Yet, of the variables we tracked, age turned out to be the biggest determinant of planned behavioral change. Younger consumers are less entrenched into “old” habits and more open to change irrespective of how closely they have been impacted.

Implications: Brands have a unique opportunity to re-engage with consumers and become part of newly formed routines. They can do this by understanding how they can serve a real purpose within consumers’ evolving behaviors and attitudes. Brands that are first and best at doing this are likely to create higher loyalty and lifetime value. By contrast, in a time of massive change and uncertainty, there may also be a role to play for brands that can provide a sense of normalcy, tradition, and comfort, especially in older consumers.

Digging Deeper: Eating & drinking habit changes are deceptively polarized

On the surface the trends seem clear: consumers plan to go to restaurants less often, will cook more meals and eat more fruit and vegetables. However, in other eating and drinking habits, aggregate trends hide polarized response patterns. In the categories that we covered (snacks, sodas, liquors, beer and wine, desserts) around 40% plan to change their frequency of consumption in the future. Yet, among those consumers we see a nearly equal amount who say they will “consume more” as will “consume less” – a contrast from other areas where there is a clear trend in one direction or the other

Implications: The way the food & beverage industry is likely to be impacted should not be taken for granted. Smarter segmentations are needed to go behind averages and guide more targeted communications. The potential for brands to win market share will depend on their ability to understand their consumer recruitment, frequency, and retention priorities and reflect these in their communication and commercial strategies.

More Food for Thought

- At a time when consumers are particularly sensitive to the challenges facing small business, how can larger brands join the conversation in a way that is genuine and ‘on target’? The “Stand for Small” coalition from AmEx and others seems to fit the bill.

- Will consumers award ‘goodwill’ to brands that give back during these times, and what does that look like for different categories and industries? Several car insurance companies offering rebates to consumers is a good example.

- As consumers experience the vulnerability of our societies to a global crisis, will we see an acceleration in the need for brands to show how they are playing an active role in taking care of our planet? Our results suggest that 56% of consumers consider ‘Taking Care of the Environment’ more important than they did before the pandemic

In the News:

Having gone through a lot of the research published so far, we have listed a few that we found particularly useful:

- IMI International – Provides a lens on several prominent consumer concerns & how they have evolved over time, including the important insight that many consumers are now tired of hearing about COVID-19

- McKinsey – Covers several interesting points relating to economic vs. public health concerns, in addition to an interesting take on which consumer services are likely to stick around after the pandemic

- Gartner – Shares some interesting guidance on the importance of local business in consumers’ minds and the differences in mindsets between generations

Below you will find two references to System Dynamic models that help to provide a picture of the future:

- The first contains a video showing the causal relationship between various factors (and the resulting feedback loops) that drive the spread of an epidemic.

- The second is also based on a “susceptible-exposed-infectious-recovered” (SEIR) model, commonly used in epidemiology. It enables users to explore the impact of government and citizen responses by allowing you to change the parameters (such as testing kits availability, or length and depth of lockdown) and see and how they alter the course of the pandemic outbreak