What drives consumer choice?

Message From Vittorio

Welcome to our Spring newsletter! In this issue, we discuss a technique known as Structural Equation Modeling (SEM), a bit of a scary name for something that has been around for nearly a century but today thanks to advanced software programs can efficiently deliver superior insights – and it certainly did for one of our clients!

We also discuss the recent news on Kraft Heinz as we finally start to see the longer-term impacts of zero-based budgeting on big iconic brands.

Hope you enjoy reading, and as always feel free to get in touch with any feedback or questions!

Vittorio Raimondi

Managing Director, Foresight Associates LLC

Case Study: What drives what drives what drives consumer choices?

One challenge posed by the high number of metrics marketers track is the ability to prioritize which variables are most likely to influence consumer behavior. This can at times result in analysis paralysis or, in some cases, too much focus on a few “silver bullets”.

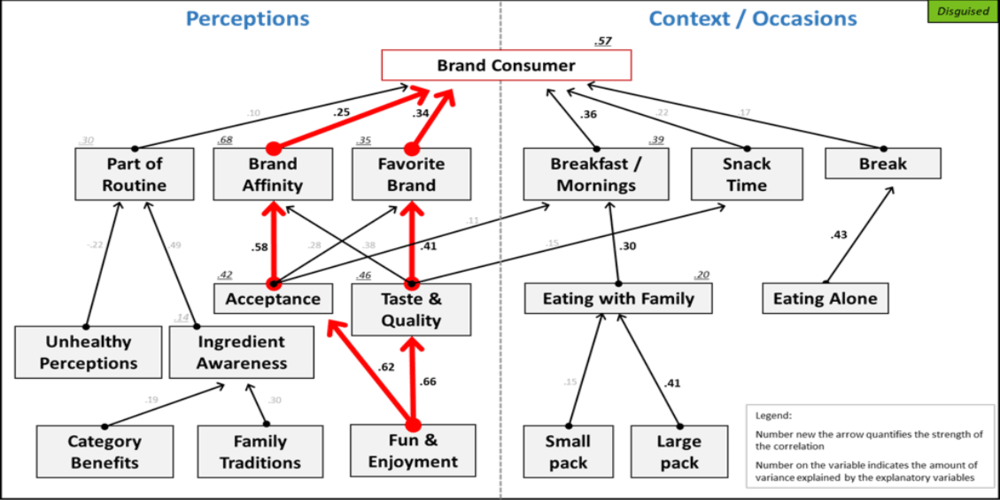

The good news is that there is a readily available solution called Structural Equation Modeling (SEM). Commonly used for causal modeling (“path analysis”) and/or factor analysis, SEM is a multivariate technique that can reveal the interconnected and hidden relationships across a set of variables. It allows us to model a more complex yet more accurate reality than traditional statistics.

SEM has been around for ages, but improvements in statistical software mean that the heavy calculations required can now be applied with relative ease.

Interestingly, many marketing teams still do not use it and focus instead on insights that can be gathered from high-level, descriptive statistics.

To understand the implications, consider a hypothetical confectionary company called “Foresight Chocolatiers” – okay, let’s not give it a name – that has surveyed consumers to understand their usage and attitudes towards candy. Our chocolatiers want to understand what perceptions drive consumers to regularly choose their flagship brand.

A first pass at the data finds that “enjoy the taste” is the most correlated variable with product consumption, followed by “good value” and “natural ingredients.” In truth, that’s where many marketing analyses end, but SEM works to reveal the underlying structure.

Based on deeper statistical analysis, SEM reveals that “natural ingredients”, is in fact a driver of “good value”, which itself drives “enjoy the taste” (i.e., consumers who do perceive that the product has quality ingredients are more likely to appreciate the value, and therefore get more enjoyment out of the taste!). Given this hidden impact, it turns out “natural ingredients” is statistically the most important message for driving consumption of the flagship brand!

Below is how an SEM Map would look like in a hypothetical case:

In the News: Kraft Heinz shows why clear marketing strategy matters

You may have heard the rumblings – a $15 billion write off, a plunging stock price, and now a CEO shakeup – Kraft Heinz is facing significant challenges. And the new boss has a big job: return a family of brands that has fallen out of touch with today’s consumer landscape to organic growth.

The Kraft Heinz predicament is a case study in the limits of a philosophy called “zero-based budgeting.” The theory was that these giants of the supermarket could maintain their share while simultaneously cutting spending – particularly in marketing – and keep the profit. The result? Reduced investment in brand building, a meager innovation pipeline, a talent drain, and a blow to relationships with agency partners and retail customers alike.

The takeaway is not just that marketing dollars matter. In an ever more fragmented retail environment, clear consumer-centric strategy is essential for both building brands and retaining their existing consumers. Take the example of the condiments aisle – a space Kraft Heinz dominated with ubiquitous brands. Although ketchup is still strong and growing, they may have missed that the category itself is expanding with an ever-growing variety of diverse and healthy alternatives from Sriracha to avocado spread. This speaks to a loss of focus in the dynamics of growth, and how a brand must position its portfolio to capture those dynamics.

If you’re looking to understand more about the situation, we’ve enjoyed these two articles examining what went wrong:

Kraft Heinz can’t count on ketchup to save it from the future of food