Unlocking Profitable Growth: A Three-Step Pricing Framework

Pricing is a delicate balance. Due to inflation pressures and a nightmare supply chain, a pet food company faced a major challenge: how to maintain profit margin and not price out its consumer base.

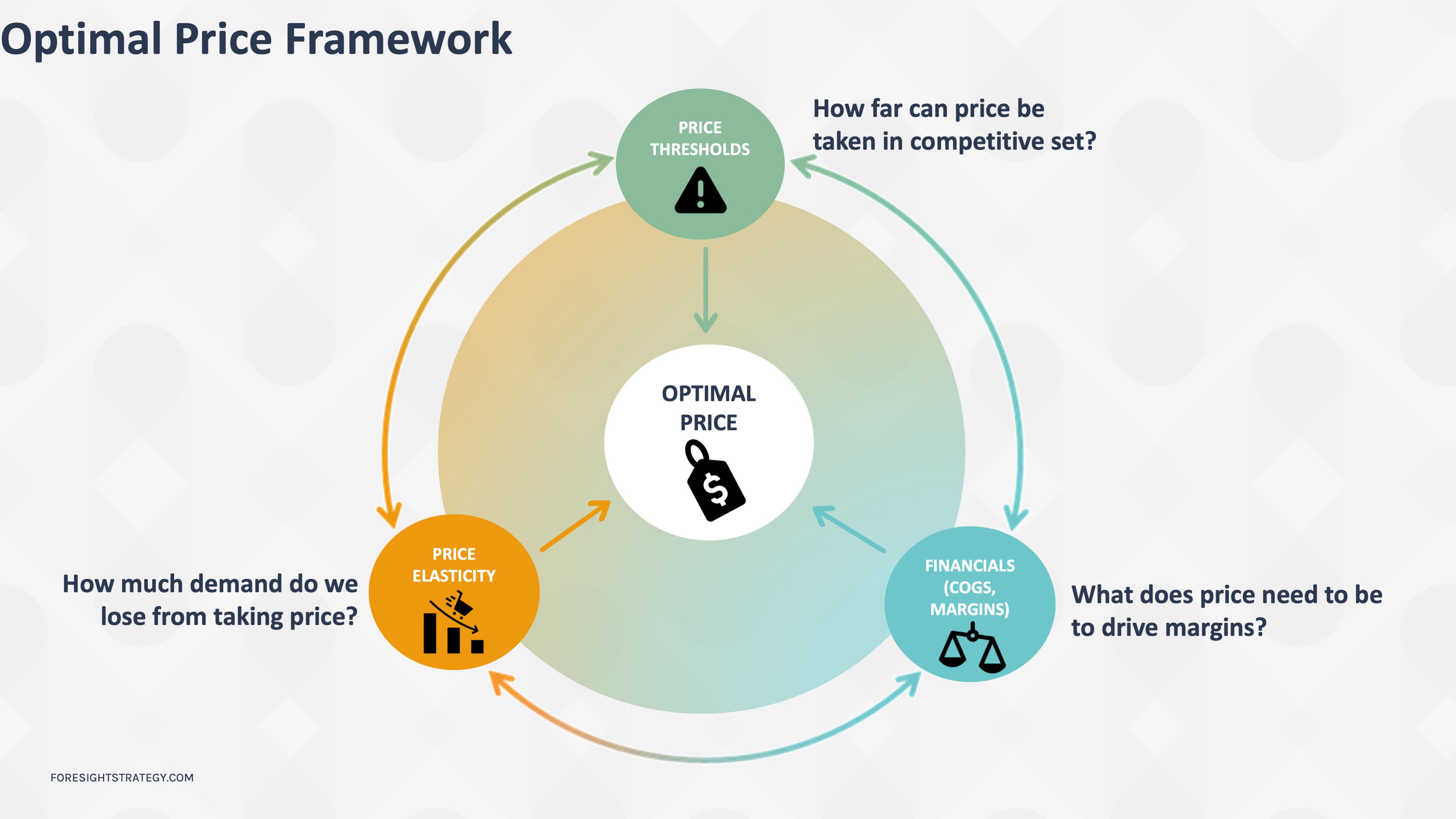

To answer this challenge, we analyzed three key components of prices: price elasticity, price thresholds, and the financials of the product

1. Price Elasticity and Sensitivity

Price elasticity, also known as price elasticity of demand, is an economic concept that measures the responsiveness of the quantity demanded of a product or service to changes in its price. In simpler terms, it shows how sensitive consumers are to price changes and how their buying behavior is affected.

We can determine how sensitive a product is to price changes by measuring (% change in quantity demanded) / (% change in price). This allows to determine which products are more and less price sensitive, how sensitive products are to price changes will play a major role in determining how much you can take price and what price point is optimal for your brand.

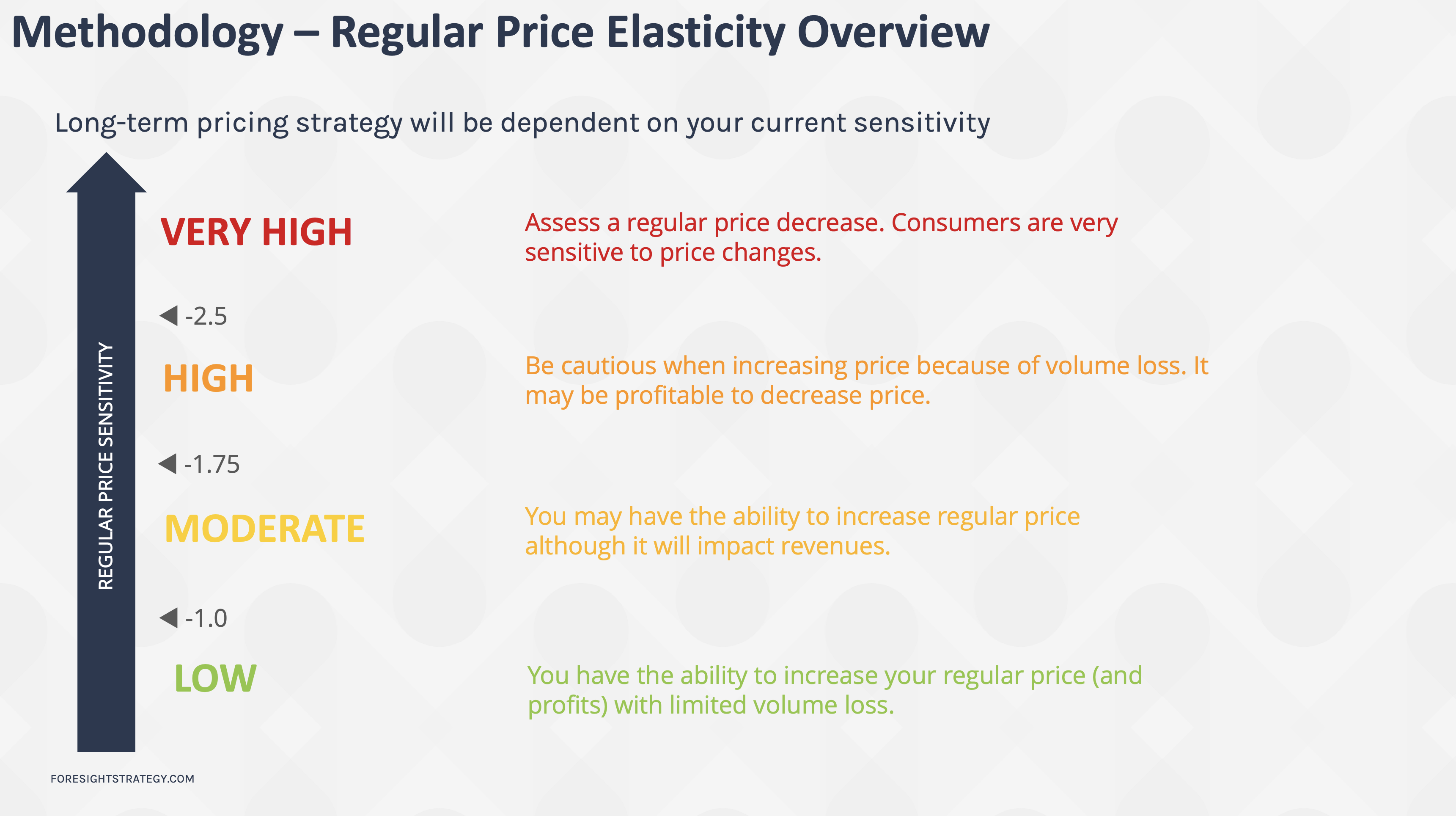

We tend to group products into a 4-point scale based on their price sensitivity from very high greater than -2.5 (% demand drops 2.5x more than % change in price), and low -1.0 (% demand drops less than price change).

We can also study how different products affect each other when their prices change (cross-price elasticities). This helps us understand if people might switch to a different product or if the products might go together.

This manufacturer’s products turned out to have a range of price sensitivity. Bigger broad market packs had lesser price sensitivity, while smaller specialty products had more price sensitivity.

Cross-price elasticity also showed many consumers typically trade down in size or protein when bigger broad packs’ price is increased. For specialty packs, when the price is increased, the demand for the entire category goes down, meaning consumers are forgoing purchases altogether.

2. Competitive Price Range

We can determine the price range of similar products in our competitive set and identify how our products are currently priced compared to the competition. To determine thresholds, we can use a price index compared to our competitive set (Our Price / Competitors Price). This price index can be tracked over time and measured against sales.

We can then determine inflection points when our price index crosses certain thresholds and we see a steep drop in demand – this allows us to determine what price level we perform best at in the competitive set and what the max index vs competitive set should be.

In this case, the manufacturer had performed well at a price point above its competitive set historically and could maintain a premium price.

3. Product Financials

One of the most important pieces of determining optimal price is the cost of producing the product. Cost can be grouped into two buckets: fixed overhead costs and variable costs (materials, manufacturing, labor, distribution, trade, marketing, and promotions).

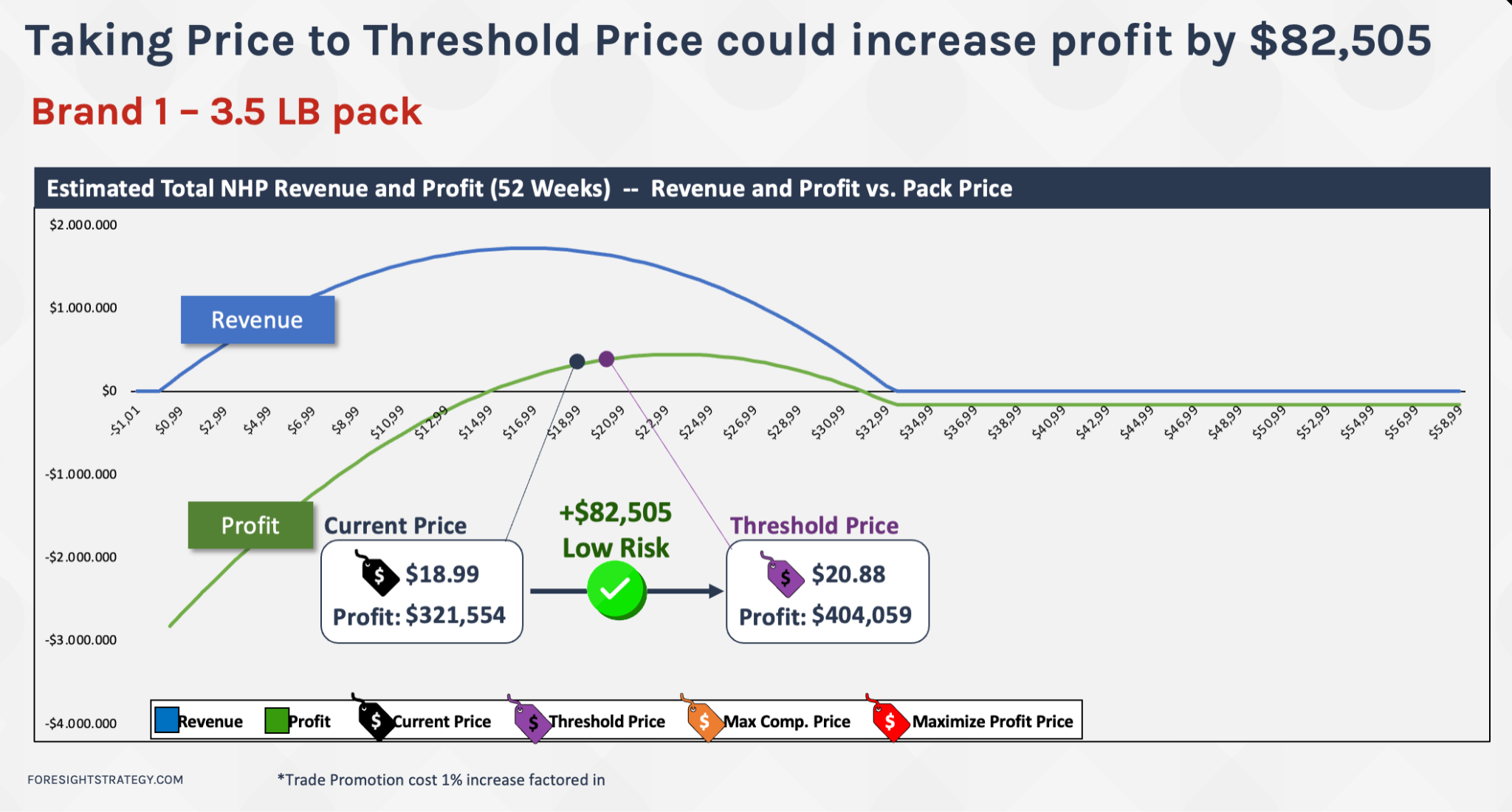

By calculating profit margins on a unit basis, you can create profit curves and calculate what price points maximize your profit. In the work we did with this manufacturer, we determined different scenarios ranging from low risk (taking the price up to the price threshold in the competitive set) to high risk (taking the price above the competitive set to the largest potential profit price point). This allowed us to determine potential profit opportunities from price increases, how aggressive the manufacturer had to be to hit target profit numbers, and how large the risk of demand loss was.

What’s the outcome?

After simulating various price increase scenarios with different risk levels, we developed an optimal price lineup for each of their products. For example, for the specific product mentioned above, we recommended an increase from $18.99 to $20.88, implying an $82k profit increase with a low risk of pricing out consumers, given that it is currently below its threshold price in the competitive set.

This three-step pricing framework can be applied across categories and industries to identify optimal price points aligned with both profit objectives and consumer price sensitivities – it provides not just a solution to immediate challenges but a robust methodology for sustained success in the dynamic landscape of pricing strategy.