The secret to winning in e-commerce: Strategy first, tactics second

Good morning, and welcome to our second quarter newsletter.

We are excited to share part two of our e-commerce newsletter series. In the first part (E-commerce – How to win online, a MUST more than ever before), published last fall, we shared the findings from our custom research on how consumer shopping habits are changing and why traditional marketing tactics are likely to fail in this new environment. In this part we share findings from our dynamic modeling work, showing why system thinking and consumer modeling are important to achieve a winning e-commerce plan.

I hope you enjoy reading this issue and feel free to reach out to us with any questions, or if you feel this work could be relevant to your business!

Vittorio Raimondi

Managing Director, Foresight Associates LLC

Using System Dynamics to Demonstrate Impact of Marketing Activities on Shopper Behavior

We have found through our experience working with brands in CPG categories that the e-commerce channel is complex and developing holistic strategies is a challenge. This is due to three main factors:

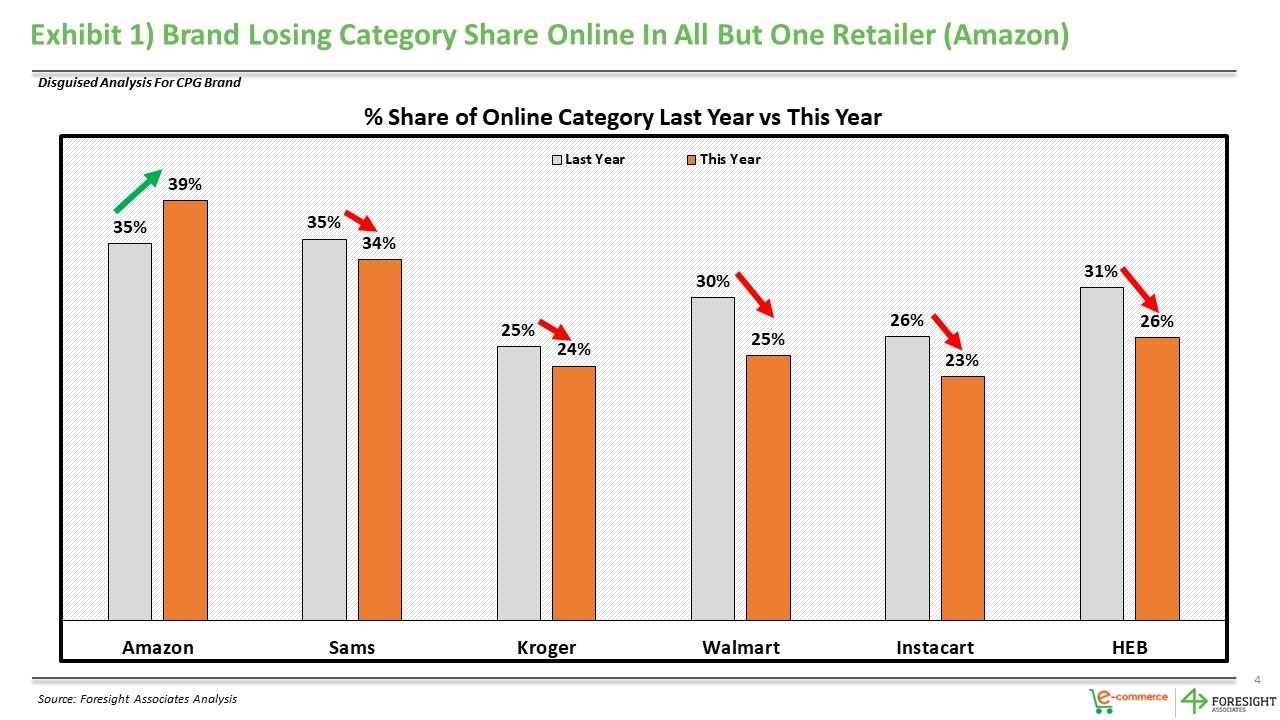

- Highly fragmented market: unlike other retail categories where Amazon makes up most of the sales, CPG sales are more evenly spread across top retailers – Instacart, Amazon, Walmart, Kroger, Sam’s, H-E-B, and others. This means e-commerce teams for CPG companies have a very difficult task: they need to not only determine how to execute efficiently on multiple retailer platforms but also how to prioritize which retailers and marketing activities to invest in.

- Many options for marketing activities: there are a vast number of potential online marketing activities, both within retailers’ platforms and outside, including digital shelf, platform advertisements and promotions, search engine optimization and social media ads. Marketing teams are often left with a finite budget but nearly infinite options.

- Inconsistent data: in part due to the fragmentation of the market, the data available from one retailer may not be available for other retailers and often is limited in depth. Making data comparisons difficult between retailers and to create a full picture of the e-commerce market requires heavy triangulation of multiple sources.

As a result, strategies and tactics that work for one retailer (e.g. Amazon) are not guaranteed to work across others. In a recent case we saw how our client’s brand was winning on Amazon but was losing category share everywhere else. What was working on one platform was not working on others.

Part of this is due to a focus on execution without a clear understanding of the shopper landscape or an overarching strategy to drive marketing activities across retailers for long term growth.

Armed with high investment in building digital skills, operational capacity, and devoted e-commerce teams, many companies can quickly adjust product positioning, pricing, and promotions based on changes in demand, but lack the ability to articulate or justify marketing activities in relation to long term goals.

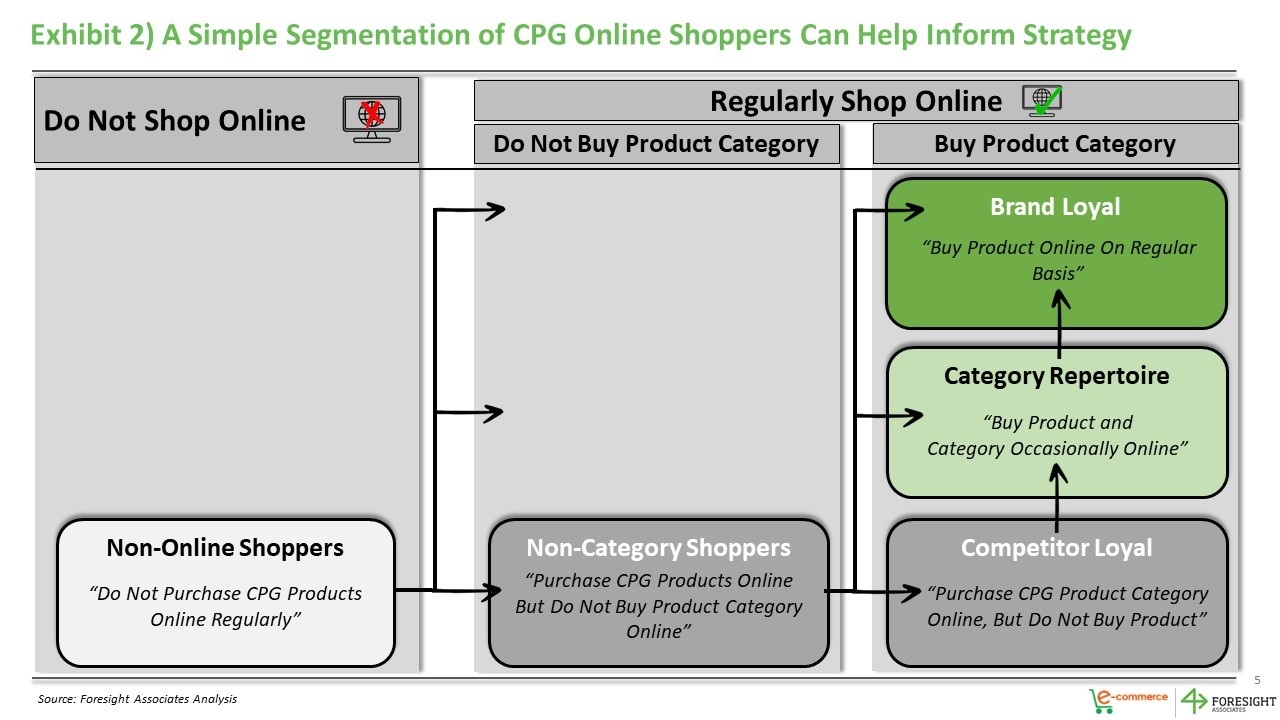

This gap can be filled by segmenting people based on their online shopping behaviors. Below is an example of a simple segmentation that can serve as a starting point.

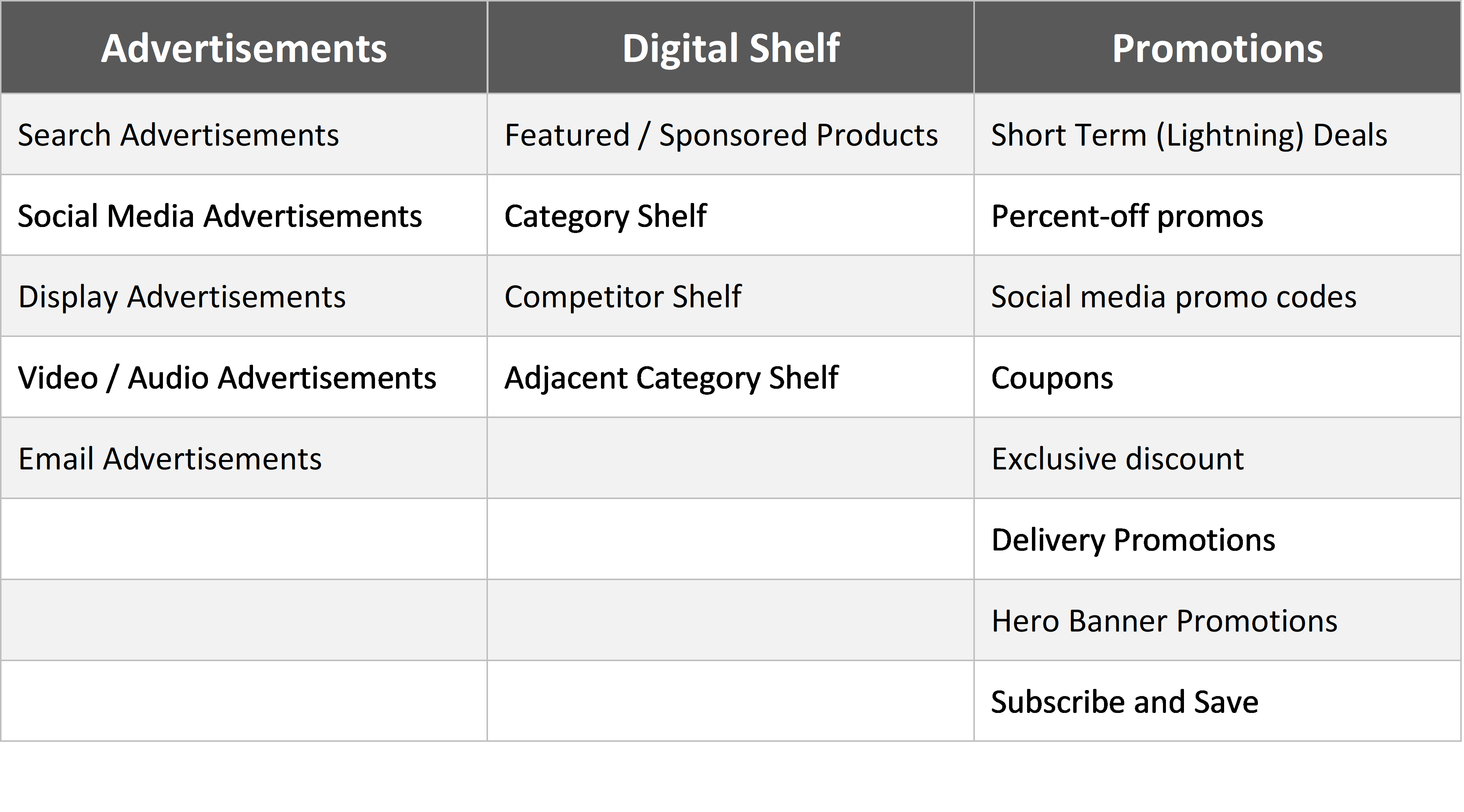

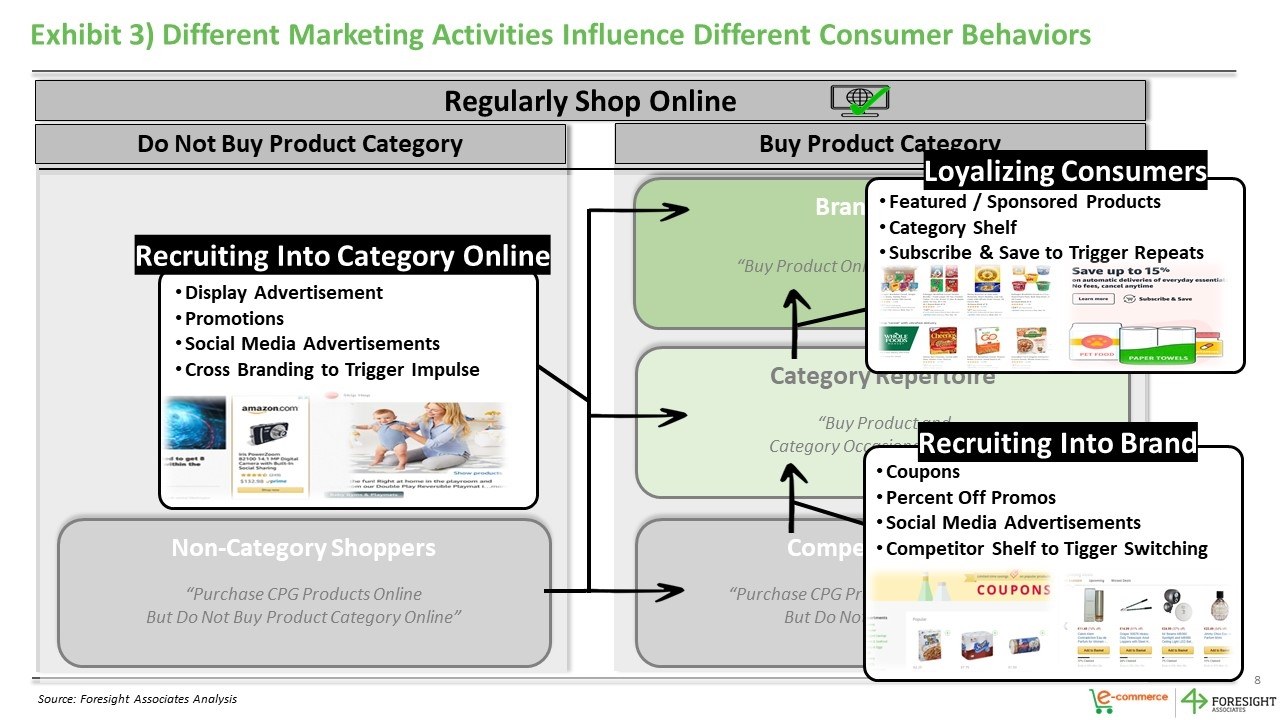

Now that we have put the consumer back at the center of our e-commerce strategy, we can start to think of which marketing activities are best suited to win the shoppers we want to target. In the table below, we have summarized several core marketing activities in e-commerce. Some are more potent than others in nature, but really what sets them apart is the type of behavior that they are designed to impact.

Think of focusing on Digital Shelf to win key searches related to your product category. If well done, this is likely to be your most powerful tool to loyalize heavy e-shoppers of the category, winning them from competing brands. But if you are trying to win shoppers that are familiar with e-shopping but do not purchase your category, then Display Ads, Promos, and Cross Branding are likely to be more effective tools.

In summary, understanding where shoppers are relative to your brand and category within the e-commerce channel is critical to identifying the right behavior to impact and ultimately driving strategic investments and execution of online marketing activities.

To demonstrate this point, we built a simple dynamic model to simulate two scenarios:

- A baseline reference scenario – “balanced spend” – evenly spread mix of online marketing activities.

- A scenario experiment – “targeted spend” – strategically focused mix of online marketing activities.

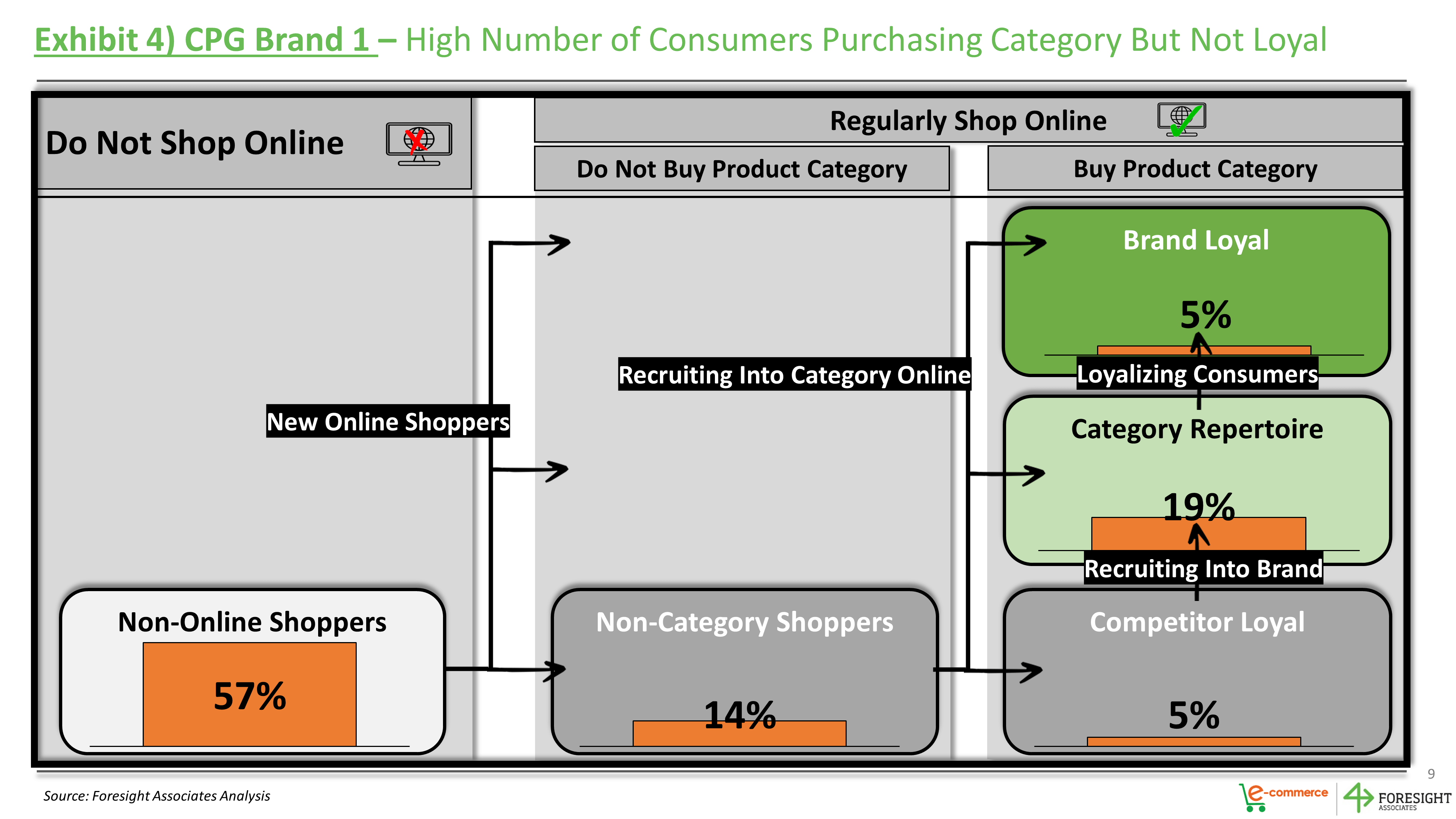

The model has been calibrated with real e-commerce shopper data from our 2020 survey, and we have assumed an equal total budget between the two scenarios. In the first case below, a slight majority of routine CPG online shoppers are buying the category, with a small population being loyal shoppers to the brand or its competitors but most buying a variety of different brands and products in the category, falling into the Category Repertoire segment. Therefore, in the targeted spend experiment, we have increased the percentage of spend on activities linked to loyalizing the repertoire shopper segment, given its relative size compared to other segments.

The dynamic simulation model calculates how each of the segments evolve over time by explicitly representing the transitions between the segments using the concept of flows. These transition flows are what our marketing activities impact and will also reflect the size of the sourcing segment – as the source is depleted then the flow will fall. These flows are the representation of the inter- dependencies in our brand architecture. Luckily, we can efficiently execute these dynamic models using specialized System Dynamics software that allows us to build rapidly intuitive toolsets – to explore alternative scenarios (industry evolution and brand strategies) and visualizations to help interpret the results.

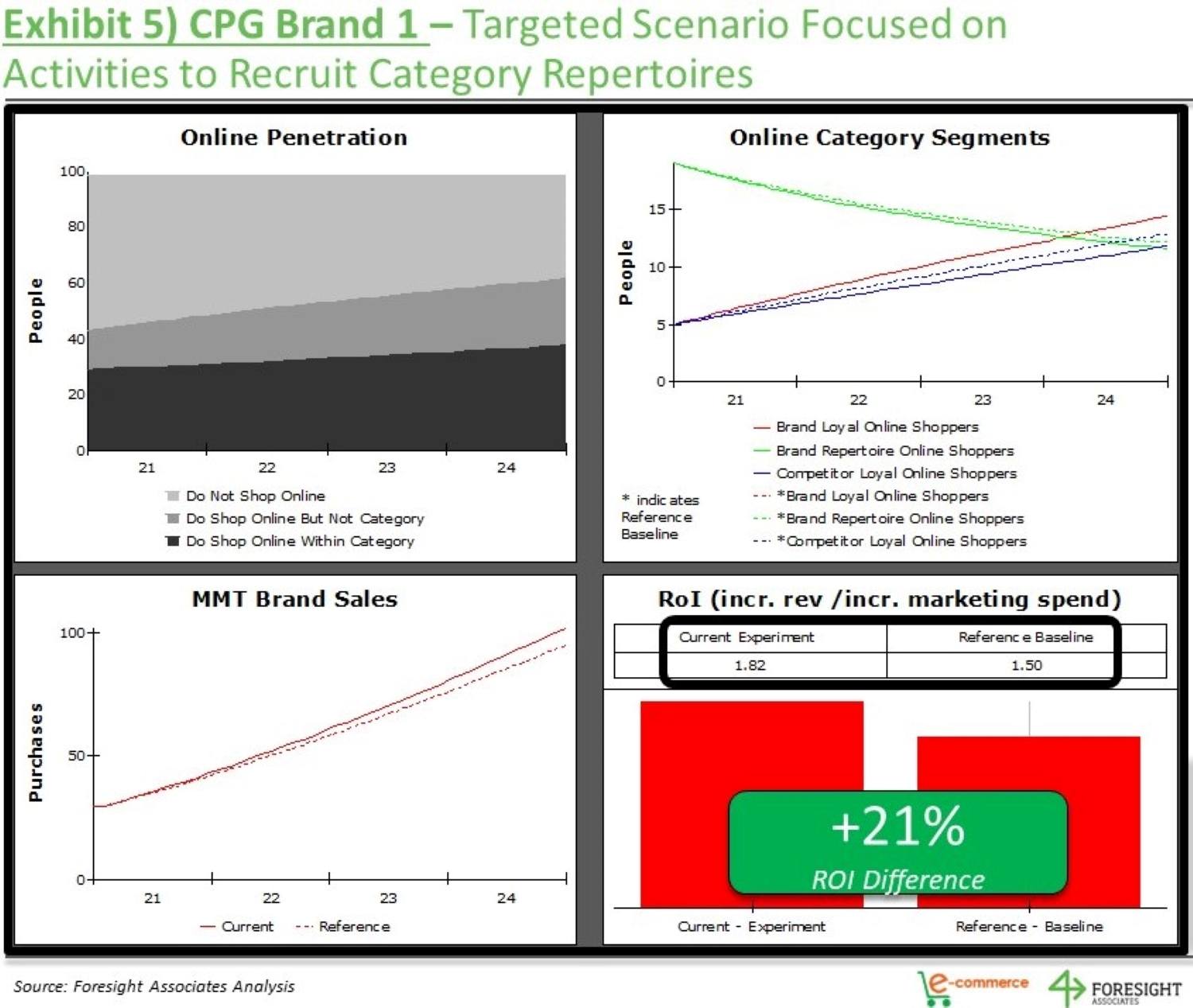

For the current case, we show high level results from the two scenarios below. Brand sales compared to the reference baseline scenario shows improvement and this can be traced to the intended increase in higher brand purchase rate loyal shoppers. This has been achieved through a balance of investment change rather than increased budgets and so we enjoy a healthy improvement in the ROI with the additional revenue generated.

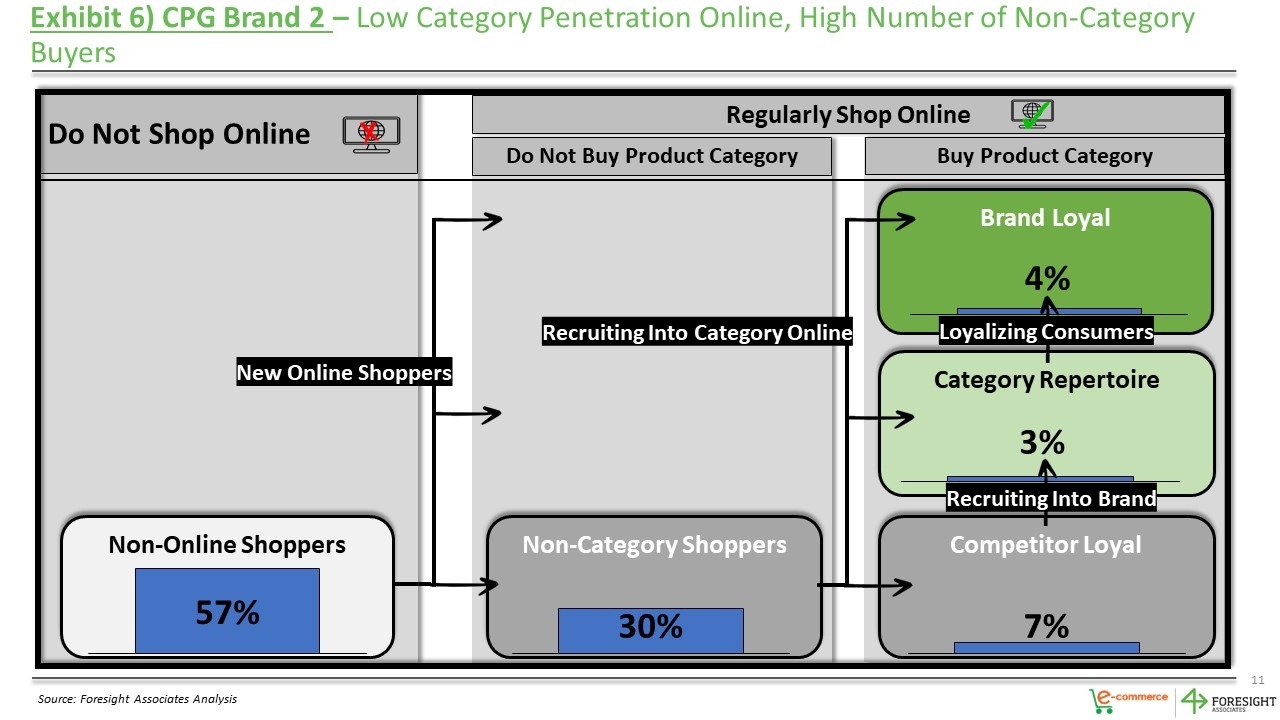

We also considered an alternative CPG brand and category. In this second case, the category is less developed with lower penetration online. Do you think the same targeted strategy we applied for our first brand will work for this brand?

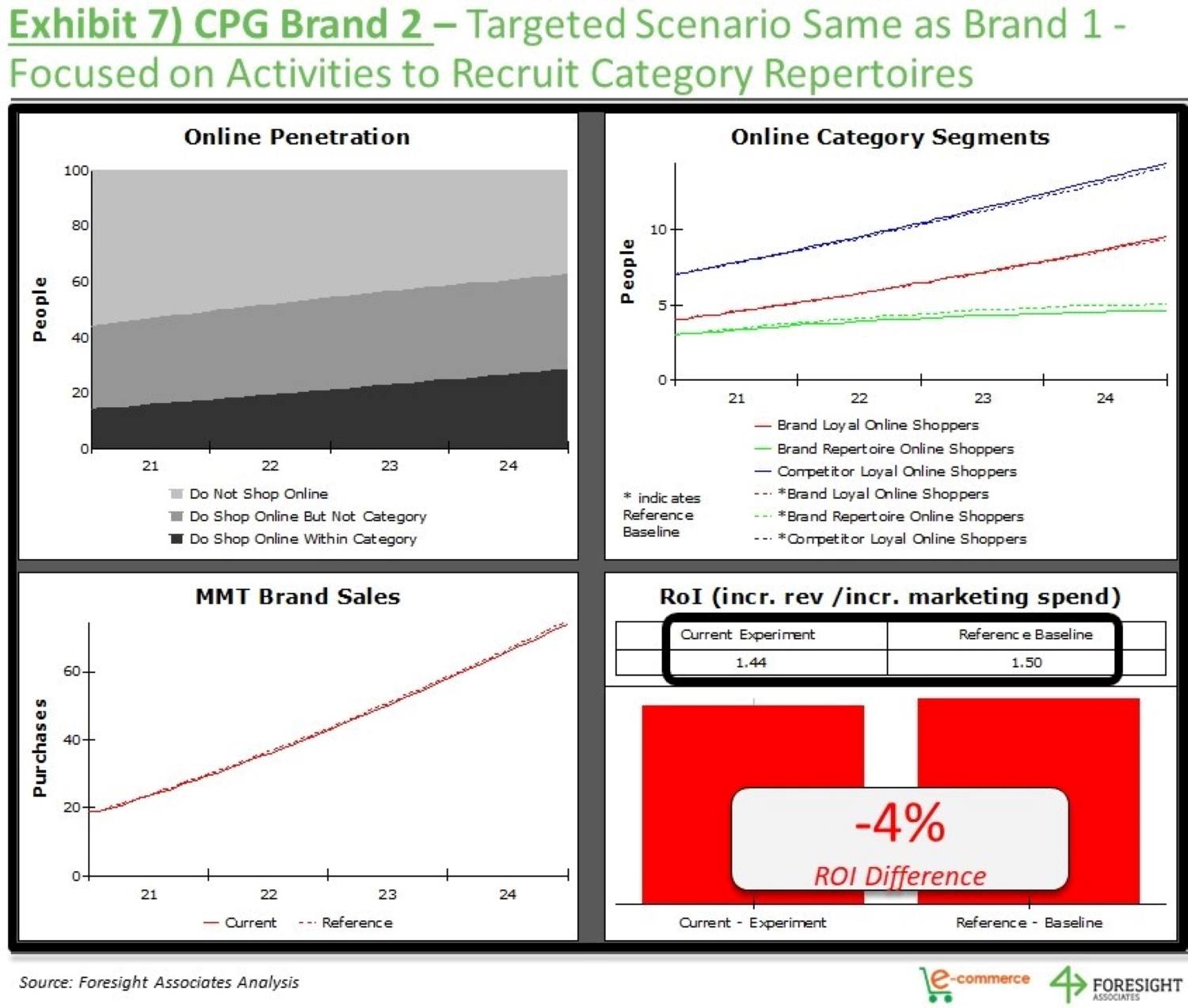

Again, we had calibrated the simulation model and generated reference baseline and experiment scenarios. Using the same targeted strategy scenario used for the previous case, the simulated brand sales and hence ROI all fall. Why is this?

When we inspect the model dynamic behavior, we see that the activities impact is equal on each segment for both brands, but the fact that the second brand has much lower penetration means it should be focusing on activities that reach new category shoppers vs winning repertoire category shoppers.

This case applies across not only different brands and categories but also by retailer. The shopper landscape could look completely different on Amazon vs Instacart, for example. Remember back to the earlier exhibit (Exhibit 1) on a brand losing share in all retailers except one (Amazon) and you can see that a strategy that works in one retailer does not necessarily work on others.

The good news is that this understanding of the e-commerce market is not hard or expensive. It can be achieved through relatively inexpensive research and triangulation of existing data sources. This framework, and the subsequent application of a sound strategy, is what truly differentiates a winning plan online.

Thank you for reading our newsletter! Please share and reach out, we would love to hear your thoughts!

Latest at Foresight

New Faces: We are excited to be expanding our team and are happy to introduce Hunter Austing. Hunter joined us in March as a Business Analyst.

Staying Sane: One of the challenges of being remote this year has been finding ways to maintain our team bond and connect on a personal level. Our solution? Since the start of pandemic, we have been hosting regular Friday happy hours with one team member leading a game or activity. Recently we have had fiercely competitive matches of Trivia, Pictionary (using Microsoft Paint), Family Feud, and even a mini herb garden planting. It has been a great way to stay connected, although we are all looking forward to getting back together in person soon. If you are interested, we are happy to share our games and would love to hear how you are staying connected and bonding with your team!

Catch up on our latest research: The Latest